Analysis of the Robotics Industry

Chapter 1 Industry Overview

According to the latest information of the International Organization for Standardization (ISO), robots are defined as programmable actuators that have a certain degree of autonomy and can move in their environment to perform expected tasks. According to the International Federation of Robotics (IFR) classification standards, robots can be divided into industrial robots and service robots. Among them, industrial robots refer to robots used in production processes and environments; Service robots refer to various robots used in non manufacturing industries and serving humans, excluding industrial robots. They are divided into personal/household service robots and professional service robots. The China Electronics Society, based on the development characteristics of China's robotics industry, divides robots into three categories: industrial robots, service robots, and special robots.

Structure diagram of the robot industry chain

In 2019, the global robot market continued to grow in size, reaching 29.4 billion US dollars, while the industrial scale in China reached 58.87 billion yuan. The industry application proportion of automobiles and components in the Chinese industrial robot market is 35.8%, electronic and electrical accounting for 28.7%, metal processing accounting for 8.2%, food and medicine accounting for 3.1%, warehousing and logistics accounting for 2.9%, plastic processing accounting for 2.8%, and other fields accounting for 18.5%. Household robots account for 35.6% of the service robot market in China, special robots account for 25.4%, medical robots account for 21.0%, and public service robots account for 18.0%.

Chapter 2 Business Models and Technological Development

2.1 Industrial Chain Value Chain Business Model

2.1.1 Industrial Chain

The upstream of the industrial robot industry chain is the core components, including controllers, servo systems, and reducers, which are the core technologies in industrial robots. In the middle of the industrial chain, robots are manufactured. FANUC, ABB, Kuka and Yaskawa have obvious advantages, accounting for 40% of the global industrial robot market share. However, domestic manufacturers are still in the catch-up stage because of their late start. Downstream is system integration, currently mainly concentrated in the automotive manufacturing and 3C electronics industries, which almost occupy half of the downstream applications of industrial robots. However, in the long tail markets such as food and beverage, logistics, photovoltaic, and lithium batteries, the growth rate is relatively fast.

Service robot:

Overall, the industry chain of China's service robot industry is relatively mature, which relies on China's mature electronic manufacturing industry to provide a supply chain foundation for the robot industry; On the other hand, emerging robot interaction technologies such as artificial intelligence are becoming increasingly mature in China. Driven by the demand for commercialization of technology, more and more enterprises are joining the commercial service robot industry and becoming important technology and solution providers. With the refined development of the industry, the division of labor in the industry has become increasingly refined, and the industrial chain has become increasingly complex. In this report, the service robot industry is roughly divided into several links, including core hardware suppliers, software or solution integrators, complete machine manufacturers, and sales channels.

Service robots refer to various high-tech integrated advanced robots that provide necessary services to humans in unstructured environments, mainly including home service robots, medical service robots, and public service robots. Among them, public service robots refer to robots that provide general services to humans in public places other than medical fields such as agriculture, finance, and logistics.

Service robot application scenarios and main classification diagrams

2.1.2 Business Model

Robot business model: The full industry chain model is the current development trend of robot enterprises and also a business model with high profitability. At present, most successful enterprises both domestically and internationally have adopted the full industry chain model of "important component production+ontology production+system integration", or are gradually infiltrating upstream and downstream to achieve the transformation of the full industry chain model. The specific models include: (1) single entity manufacturing and sales model; (2) System integration mode; (3) Core component production and sales model; (4) Ontology production+system integration mode; (5) The entire industry chain model. Enterprises that adopt the first three business models mainly engage in a single business, while enterprises that adopt the latter two models engage in two or more businesses.

2.2 Technological Development

Robots are one of the important indicators for measuring a country's technological innovation ability and high-end manufacturing level, and are known as the "pearl at the top of the manufacturing crown".

The main functions of service robots include navigation and positioning, motion control, and human-machine interaction. The main technologies involved are SLAM (positioning and map creation), hydraulic control/motor control, and artificial intelligence technology.

Main technical diagrams involved in service robots

Navigation and positioning technology enables service robots to perceive the surrounding environment and independently plan their paths for movement. The core of current cleaning robots, food delivery robots, and delivery robots is navigation and positioning technology.

Motion control technology endows service robots with the ability to move according to their needs, with core technologies including control sensors, servo actuators, reducers, etc. Servo robots are service robots centered around motion control technology.

Artificial intelligence technology has greatly improved the intelligence level of service robots, not only providing them with basic language communication and image recognition abilities, but also endowing them with emotional communication and powerful logical computing capabilities.

2.3 Policy Regulation

The competent departments of the robotics industry are the National Development and Reform Commission and the Ministry of Industry and Information Technology. The main functions of the supervisory department are to be responsible for research on industry development planning, formulation of industrial policies, guidance on industry structure adjustment, industry system reform, technological progress and transformation, formulation of industry development strategies, policies and overall plans, and formulation of industry technical standards. Some robot associations exist as self regulatory organizations.

On October 25, 2017, the first robot citizen in human history was born - the "female" robot Sophia was granted Saudi citizenship. Sophia said a thought-provoking sentence at the press conference: "If you are good to me, I will be good to you." As a product of social activities, robot rights are different from human "natural rights," and have legal fiction, altruism, and functional rights attributes. This has also formed four basic rights types: data sharing right, individual data exclusive right, freedom based on functional constraints, and the right to obtain Legal remedy. In dealing with the social risks brought by robot rights, it is necessary to clarify the boundaries and legal reservations of robot rights, strengthen the connection between laws and ethical norms of robots, and establish robot supervision mechanisms, in order to lead human-machine relations towards normalization and legalization. In the future, robots will be comprehensively regulated, and more institutions and organizations will participate in the regulation.

Chapter 3 Industry Valuation, Pricing Mechanism, and Global Leading Enterprises

Industry performance and historical valuation chart

The valuation method of robot industry can choose P/E ratio, PEG, P/B, P/S, EV/Sales, RNAV revaluation net Business valuation, EV/EBITDA, DDM, DCF discounted cash flow, NAV net asset valuation, etc.

3.2 Industry Development and Driving Mechanism and Risk Management

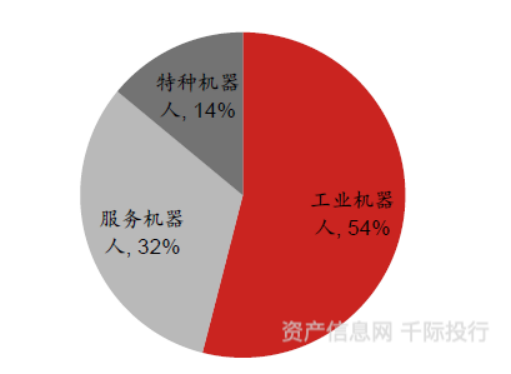

In 2019, the global service robot market size was 13.5 billion US dollars, accounting for 45.9% of the overall robot market size, and its proportion continues to increase. The global industrial robot market size was 15.9 billion US dollars, accounting for 54.1%. From the perspective of global regional development, the Asia Pacific region is the most active market for robots, accounting for 60.2% of the global market share, followed by Europe and North America, accounting for 19.9% and 17.4% respectively.

The size of the Chinese robot market continues to grow, reaching 58.87 billion yuan, with a growth rate of 9.8%. The size of the Chinese service robot market is 20.65 billion yuan, accounting for 35.1% of the overall robot market size, and the proportion has further increased. The size of the industrial robot market is 38.22 billion yuan, accounting for 64.9%. East China, Central South China and North China are the regional markets where robots are well developed in China, with market shares reaching 31.8%, 26.9% and 15.8% respectively.

3.2.1 Industry development and driving factors

Currently, the global robotics industry has entered a stage of rapid development. According to data from IFR and the China Electronics Society, China's industrial robots have entered the industrialization stage and become the world's largest industrial robot application market. The overall sales volume of robots in China is showing an increasing trend year by year. In 2019, the sales volume of robots in China was nearly 60.8 billion yuan, mainly industrial robots, with a weight ratio of 66%. In 2019, the scale of China's industrial robot market was nearly 40.1 billion yuan. In 2019, the robot market in China was mainly dominated by industrial robots, with a weight ratio of 66%, far higher than service robots and special robots. The proportion of service robots is 25%, and the proportion of special robots is 9%. As one of the largest robot markets in the world, China has developed rapidly under multiple stimuli such as domestic policies, technology, and market demand.

Industrial robots:

According to data from the National Bureau of Statistics, the growth rate of China's industrial robot production has gradually slowed down since the end of 2017. Since September 2018, China's industrial robot production has entered negative growth, and the industry has continued to be sluggish. This is mainly because industrial robots, as typical general equipment, have a certain periodicity and are greatly affected by the prosperity of downstream industries such as automobiles and 3C. However, since October 2019, the growth rate of China's industrial robot production has turned positive for the first time, and has maintained an upward trend. The growth rate has repeatedly hit new highs. Although affected by the COVID-19 epidemic in early 2020, it has not changed the upward trend of the industry.

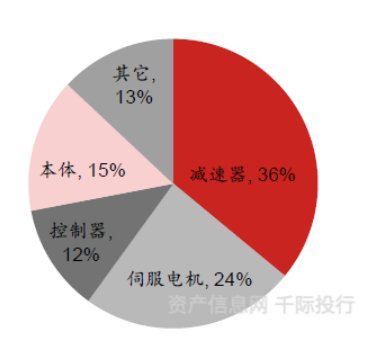

Cost proportion chart of industrial robots

Service robot:

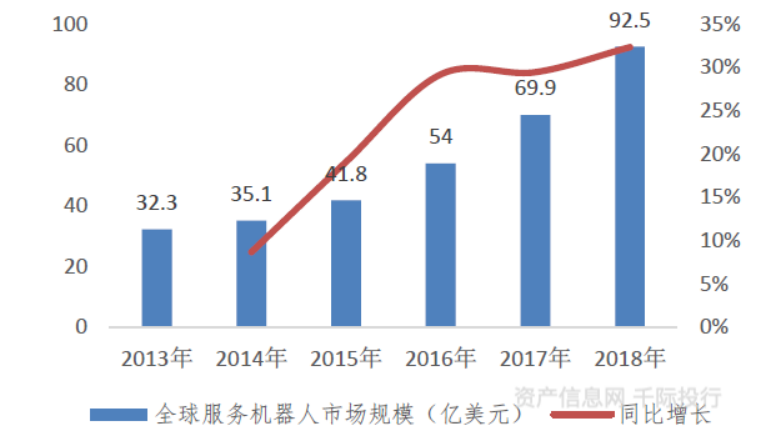

Global Service Robot Market Size and Growth Chart

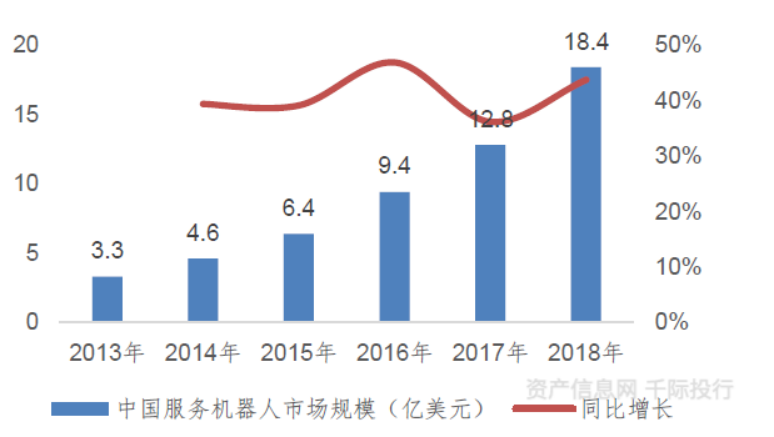

Scale and Growth Chart of China's Service Robot Market

Drivers

Widely used in the industry, the growth of application demand drives the development of the industry; Industrial robots are widely used in the manufacturing industry, with varying degrees of application in daily production and manufacturing processes in industries such as automobiles, 3C electronics, metal processing, plastics and chemicals, food and beverage, and biopharmaceuticals. Industrial robots can replace people in repetitive, routine, and high-risk tasks, thereby improving work efficiency.

Intelligent manufacturing forces downstream transformation and upgrading, driving market demand; The current global new round of manufacturing industry transformation is emerging, which has had a profound impact on the development and division of labor of the manufacturing industry. Developed countries have implemented the "re industrialization" strategy, while developing countries actively participate in global industrial re division of labor. Intelligent manufacturing has become an important development trend in the manufacturing industry globally, promoting the formation of new production methods.

There is a strong demand for localization of reducers; China's reducer industry has a high degree of marketization. In recent years, with the introduction, digestion, absorption and re innovation of advanced technologies of foreign-funded enterprises by Chinese reducer manufacturers, general transmission reducer products have gradually achieved Import substitution industrialization, and Chinese reducer manufacturers have occupied a major position in this field.

Policy dividends promote the development of industrial robots; Since 2012, national ministries and commissions have formulated a series of policies to promote the development of the robot industry.

The increase in labor costs and the vast development space for robots; Under the trend of gradually decreasing labor force and aging population, the labor costs of traditional manufacturing continue to rise. As the cost of industrial robots gradually decreases to the average level of labor costs, the willingness of manufacturing enterprises to replace people with machines continues to grow, which will drive the release of demand for industrial robots and gradually complete daily assembly line work by industrial robots.

3.2.2 Industry Risk Analysis and Risk Management

1. The price of robot products or services and the risks brought by changes in supply and demand. With the explosive growth of the robot market, more and more enterprises are entering this market. At the same time, the demand for robot products is influenced by macroeconomic and industry cyclical changes, which may trigger changes in robot product prices.

2. The adequacy, stability, and price changes of robot raw materials, key components, and other supplies pose risks. The manufacturers of key components for robots are relatively concentrated, and most of them are controlled by foreign companies, with significant pricing power, which may pose market risks.

3. Regarding the credit risk of customers and major suppliers, as most robot companies allow customers to credit, there is a risk of not paying on credit. At the same time, the production and operation of enterprises require various production factors. If suppliers cannot provide these production factors in a timely manner according to the contract requirements, there is a possibility of supplier credit risk, leading to the inability of the enterprise's production and operation to proceed normally.

The risks brought by tax policies and changes in interest rates and exchange rates make the robotics industry susceptible to the impact of national industrial policies.

5/Risks brought by competition between potential entrants, competitors, and substitutes. The threat of potential entrants entering, the threat of existing enterprise competition, and the threat of substitutes can all trigger market risks

6/Technological innovation risk, technological innovation risk is a dynamic risk with its complexity. Changes in external or internal factors of the technological innovation system, such as economic, social, technological, policy, market, and other factors, as well as inadequate management in research and development, market research, and marketing, may all lead to the occurrence of risks.

3.3 Competitive Analysis

Figure of the global robot market structure by category in 2019

Industrial robots:

Currently, industrial robots have been widely used in industries such as automobiles, 3C electronics, metal products, plastics, and chemical products. With the continuous improvement of performance and the clarification of various application scenarios, China's industrial robot industry is showing a trend of continuous deepening and expansion of application. Currently, China's industrial robot market accounts for about one-third of the global market share, It is the world's largest industrial robot application market. In the entire year of 2019, a total of 365000 sets of industrial robots were added globally, with Asia accounting for two-thirds of the total global installation. Among them, China led the way with 140500 sets of installation, almost three times that of second place Japan.

The United States is the birthplace of industrial robots, adopting an integrated application development model. It purchases industrial robot hosts and complete sets of designed supporting equipment globally, and imports them from engineering companies for integrated production line design, peripheral equipment research and development, and integrated debugging applications. Japan's industrial robot technology originated from the United States and is currently known as the "Kingdom of Industrial Robots". Japan has the most complete industrial chain of industrial robots, with the largest industrial scale and strength in the world. It has industrial robot suppliers with international influence, such as FANUC, Yaskawa Electric Corporation, Kawasaki Heavy Industry, Durr, Stiubli, etc., and core parts suppliers such as Nabtesco are in a monopoly position in the world.

Europe is one of the main players in global industrial robots, and has achieved complete autonomy in core components such as sensors, controllers, and precision reducers. KUKA from Germany, ABB from Switzerland, COMAU from Italy, AutoTech Robotics from the UK, Siemens and other companies are among the world's top industrial robot manufacturing companies. Taking ABB's robot business as an example, they believe that the main competitors include: FANUC, Kuka, Yaskawa, Kawasaki, Durr, Stiubli, General Robotics, Rockwell Automation and Siemens.

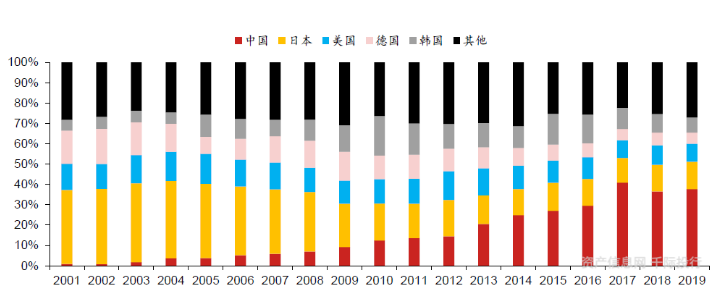

Changes in the historical proportion of installed capacity in major countries of global industrial robots

The development of the industrial robot market in the United States has also been steadily increasing in recent years. With the gradual application of technologies such as robot innovation research and human-machine collaboration development, the sales of industrial robots in the United States reached 40300 units in 2018, a year-on-year increase of 21.6%; In 2019, the domestic sales of industrial robots in the United States reached 33300 units, a year-on-year decrease of 17.5%, and the CAGR during the ten-year period reached 17.16%.

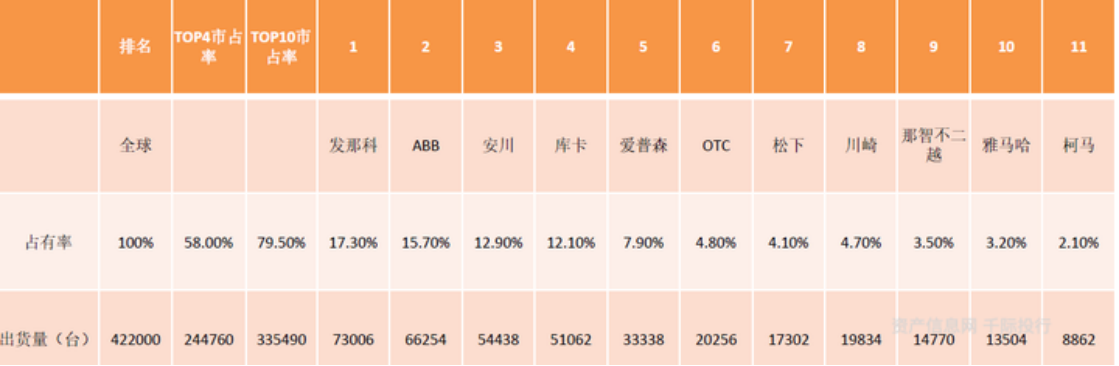

Global Industrial Robot Market Share (2018) Chart

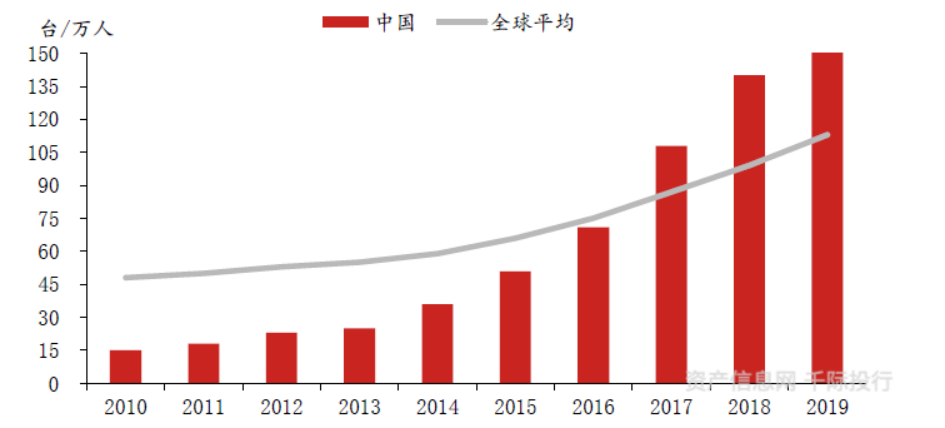

Density Change Map of Industrial Robots in China

Service robot:

The service robot industry started late and is still in the early stage of development. China is at a similar level of development with foreign countries, and a number of outstanding enterprises have emerged, such as the sweeping robot enterprise Kevos and Roborock, the UAV enterprise Dajiang, the patrol robot enterprise Yijiahe, and the humanoid robot enterprise must be selected.

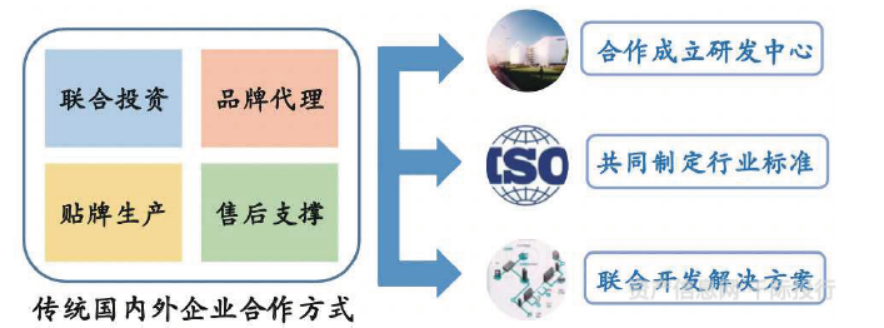

Development Map of Robot Cooperation in Multiple Fields at Home and Abroad

Take FANUC as an example to analyze the main business structure chart

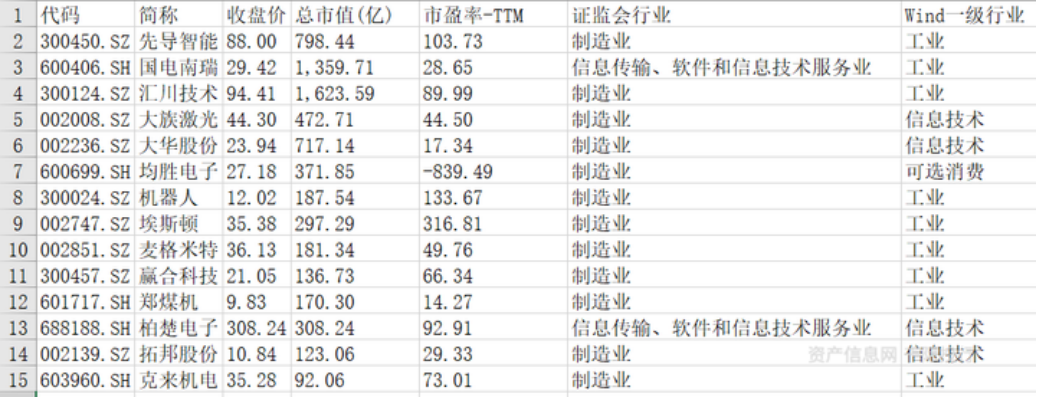

Ranking of Chinese Enterprises

A-share related listed companies chart

Eston [002747. SZ]: The company's business covers the entire industry chain from automation core components and motion control systems, industrial robots, to robot integrated applications, building a comprehensive competitive advantage from technology, cost, and service. The company's business is mainly divided into two core business modules: one is automation core components and motion control systems, and the other is industrial robots and intelligent manufacturing systems. As one of the influential enterprises in the field of motion control in China, the company has completed the strategic transformation of its automation core component product line from AC servo systems to motion control system solutions, and its business model is achieving a comprehensive upgrade from single axis to single machine to unit; The industrial robot product line has achieved rapid development with the support of the company's independent core components, establishing the company's leading position in the domestic robot industry. By promoting the strategy of "ALL Made By ESTUN" robot product line, the competitiveness of the entire industry chain of core components - industrial robots - robot intelligent system engineering has been formed, and a comprehensive competitive advantage from technology, cost to service has been constructed.

Robotics [300024. SZ]: The company is a high-tech listed enterprise dedicated to the manufacturing of digital intelligent high-end equipment, with unique robot technology as its core. The company's robot product line covers five major series: industrial robots, clean (vacuum) robots, mobile robots, special robots, and intelligent service robots. In terms of high-end intelligent equipment, the company has formed the industrial cluster development of intelligent logistics, complete automation equipment, clean equipment, laser technology equipment, rail transit, energy-saving and environmental protection equipment, energy equipment, and special equipment. The company is one of the most comprehensive manufacturers of robot product lines internationally and also a leading enterprise in the domestic robot industry. The company has now formed a complete industrial chain that integrates independent core technology, key components, leading products, and industry system solutions, and has upgraded its industrial strategy to cover the entire digital and intelligent manufacturing process of the product lifecycle.

Kovos [603486. SH]: The company's main business is the research, development, design, production and sales of intelligent household equipment and related parts such as various home service robots, cleaning Small appliance, and is one of the world's famous home service robot manufacturers. After years of development, the company has formed a relatively complete product line of home service robots, including sweeping robots, window cleaning robots, air purification robots and housekeeper robots, as well as a product line of cleaning Small appliance with a wide range of products.

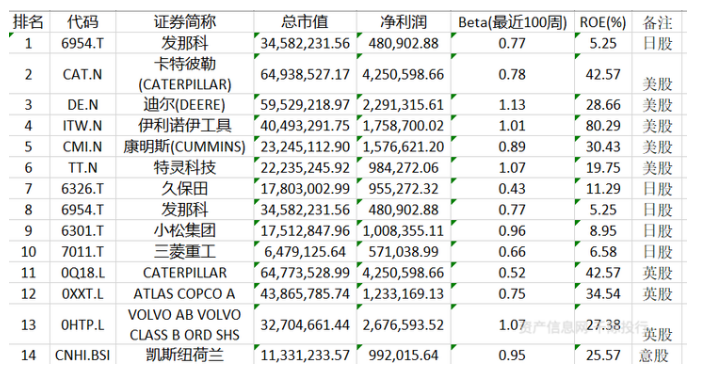

Global Important Competitors

In addition to the above companies, such as Microsoft, Intel, NVIDIA, etc., they are also on the list, and China Geek+has been on the list multiple times.

Figure Foreign Listed Companies

FANUC [6954. T]: This company is a Japanese manufacturing company, mainly engaged in providing factory automation (FA) machinery. The company operates three business departments. The FA department is engaged in the development, manufacturing, sales, and maintenance of FA products, such as computer numerical control (CNC) systems and laser products. The robotics department is engaged in the development, manufacturing, sales, and maintenance of robot products. The robotics department is engaged in the development, manufacturing, sales, and maintenance of robodrill, roboshot, robocut, and robonano products.

KUKA [KU2. DF]: KUKA is an internationally active automation group with sales of approximately 3.2 billion euros and approximately 14200 employees. As one of the world's leading providers of integrated automation solutions, KUKA provides customers with all services: from robots to batteries, to fully automated systems, as well as networks in markets such as automotive, electronics, general industry, consumer goods, e-commerce/retail, and healthcare. The company is headquartered in Augsburg.

ABB Robotics: ABB is a global technology leader committed to promoting social and industry transformation and achieving a more efficient and sustainable future. ABB integrates intelligent technology into electrical, robotics, automation, motion control products and solutions through software, with operations in over 100 countries and regions worldwide and a workforce of 110000. The robotics department mainly includes products such as motors, generators, frequency converters, mechanical power transmission devices, robots, wind power, and traction converters.

Chapter 4 Future Prospects

The foundation and cutting-edge technology of global robotics are rapidly developing, involving various aspects such as engineering materials, mechanical control, sensors, automation, computers, life sciences, etc. A large number of disciplines are rapidly developing through mutual integration and promotion. The trend of technological innovation mainly revolves around three key areas: human-machine cooperation, artificial intelligence, and biomimetic structures.

Industrial robots: Intelligence and flexibility are the development trends of industrial robots; In recent years, robot related technology has developed rapidly, mainly involving engineering materials, mechanical control, sensors, automation, computers, and other aspects. In terms of technological innovation, it mainly focuses on three key areas: human-machine collaboration, artificial intelligence, and biomimetic structures. Overall, intelligence and flexibility are the main development directions of current industrial robot technology.

Service robots: Technologies represented by artificial intelligence, cloud computing, and the Internet of Things will drive the service robot industry to rapidly move towards intelligence, innovation, and digitization. Robots are expected to become the gateway and connector of scene data in the future, becoming an important link in achieving full scene digitization and cloud edge collaboration integration. With the promotion of national strategy and the development of industrial chain, more and more organizations and individuals will participate in the service robot industry. The development pattern of "government, industry, education, research, application, and investment" will gradually form, laying a good foundation for the ecological development of robots. The industry chain of service robots will gradually improve, technological innovation achievements will gradually accumulate, and the industry will become more large-scale and systematic. The diversification of user needs and the increasing development of new technologies will bring significant development opportunities to the service robot market.

Special robots: By combining perception technology with new materials such as biomimetics, their intelligence and adaptability are continuously enhanced; The development of post disaster rescue robots has become a hot topic, and mining robots have begun to expand into deep-sea space.

Follow us

Follow us